LGB’s Market Commentary for Q3 2023.

Fixed Income.

Bonds Back in Fashion.

Over the last year there has been a slow reawakening of interest from private investors and wealth managers in investing in bonds – though most UK wealth managers have painfully little expertise to offer, and even the major investment platforms are having to rediscover how to deal in these instruments. The instinct is of course to push investors into funds, but in the UK bond funds come with the significant disadvantage of not offering the capital gains tax exemption that can be available through investing in qualifying corporate bonds (QCBs) trading at a discount to their redemption price – which is most of those issued since the global financial crisis. In addition, the damage done to bond prices by rising yields and therefore to the performances of bond funds, which usually have durations of around 5 years, has obviously discouraged those whose wealth managers persuaded them that long debt was part of a diversified portfolio. The Financial Times (FT) last weekend reported UK retail outflow from debt funds (£356m in August) as well as a small net inflow (£29m) in money market funds.

In the US the response to uncertainty has been the emergence of what has been dubbed the “T-bill and Chill” strategy. The FT reported Jeffrey Gundlach, a US bond investor as saying that as well as being able to get over 5.5% in (US) T-bills “You can get 9% in bank loans. You can get 7.5% from floating-rate triple-A assets”. The emergence of retail trading platforms such as ‘Public’ has accelerated inflows into money market funds, which amount to $880Bn this year, bringing the total value of these funds to $5.7Tn.

Investment Opportunities

The choice of assets in the UK is different and more limited. LGB is able to offer access to the weekly UK T-Bill auctions via its platform with the latest rate indications around 5.40% for 6 months. The minimum investment is £50,000 (subject to other investors enabling us to submit a minimum auction bid of £500,000). LGB also provides access to investment grade corporate bonds via its platform. Our weekly bond list is available to investors interested in building fixed income portfolios.

For those looking for higher rates, whilst they are not rated or liquid, Medium Term Note (MTN) issues arranged by LGB effectively create a high yield investment category for our clients. New issues this quarter offer between 9% and 12% depending on the issuer and security arrangements. The LGB Fund, which is invested in a selection of both LGB-originated and other issues offers the advantage of diversification and liquidity. The LGB Fund has delivered consistent returns since 2018 and currently has an implied yield of just under 7%. The duration of the fund is less than two years.

Looking Ahead

While we have seen a partial return to what those of us with grey hair think of as investing normality, we are back in the world of bond vigilantes. With central banks no longer absorbing apparently endless issues at remarkably low interest rates, the market is back in the driving seat. This has been evidenced by the high level of volatility and the extreme market moves seen so far in this transition period to a higher rates paradigm. One of the lessons of the market’s response to the brief Truss/Kwarteng administration was that you cannot buck the market indefinitely. Are rates now high enough for it to be sensible for investors to invest long term? Historically a 1.5 percentage point yield premium over anticipated inflation might have been thought adequate. Your view on future inflation has to be a key driver as to whether you think a 5% 30-year annuity (i.e. a 30 year Gilt) is a good deal or not. The Fed and the Bank of England both have 2% target rates over time. Critics suggest 3% or 4% is more appropriate. If the Fed gets back down to 2% (or even the Bank of England to 3%) and markets believe they can sustain those levels then there are going to be some huge capital gains on long bonds. If….

(Index linked Gilts and US TIPS, both with their own peculiarities, are a subject for another day. Both failed to protect investors from the surge in inflation over the last two years, as the negative effect of rising yields outweighed the inflation protection effect – if we are indeed near the top of the rate cycle that should cease to be a problem).

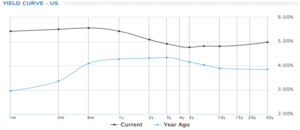

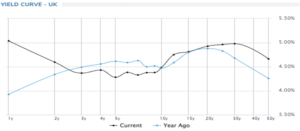

A comparison of the yield curves now and a year ago in the US and UK is instructive (source Marketwatch):

The market is offering an additional 100 basis points of yield at the long end as well as 250 basis points at the short end in the USA.

The dynamics of the US market are influenced by the increasing supply glut. With so many developed market governments needing to boost issuance, yields are tending to be forced up across all markets. The US Treasury is issuing more long-term debt – expectations are for it to reduce the amount of its net supply to the market met by T-bills as opposed to bonds from c. 60% to perhaps 15% next year. This may represent more pressure on the middle and longer end of the US bond market.

Slightly different dynamics are at work in the UK, and of course a huge amount of damage was done a year ago. Reversal of quantitative easing is providing supply of bonds as in the USA – in the UK it was put on hold in the wake of the gilts crunch of September 2022, but here too it is very much back in place now.

Equities

In the Doldrums

Equity markets have by and large offered a meagre alternative. Over the third quarter the Nasdaq Composite index dropped 4% and the S&P 3.3%, both apparently as a result of the Fed’s increasingly aggressive rate hiking cycle. YTD the S&P is up 13% and NASDAQ is up 38%. However, the apparent strong performance of the US market this year is in any event really a function of the strong performance of a small number of very large companies – The Seven big tech stocks, which represent 28% of the market cap of the S&P500. Gains have ranged YTD from 35% (Apple and Microsoft) to over 200% (Nvidia) (the others are Amazon, Alphabet, Tesla and Meta). Equally weighted, the S&P is flat and the NASDAQ is up 18% this year. This year NASDAQ has just made up for last year’s underperformance against the S&P (minus 33% v minus 19% respectively). The gravitational pull of the big stocks has dragged investors into ETFs and index funds which are not concerned with concentration risk – more orthodox strategies such as value investing have shown low single-digit returns.

In the UK the FTSE 100, more or less bereft of technology, is flat YTD. The AIM All-Share index has dropped 18% since January. New issue activity is subdued.

IHT

The AIM market is caught to some extent by the attraction it offered of being a haven to IHT: the press (mostly the Daily Telegraph so far) has run stories suggesting either that the current government will commit to the abolition of inheritance tax entirely, which would render the use of AIM as a shelter pointless, or that an incoming Labour administration would review the various current business reliefs (including agricultural land and private companies) in their entirety. The betting odds would suggest that the return of a Sunak administration is unlikely, and the abandonment of IHT anyway feels like kite-flying. Would a Labour government follow the advice of the IFS and the Office of Tax Simplification or might it nibble away at the edges and duck full-scale reform when it realised the damage that this might do to small company funding? Hard to say. In the meantime, uncertainty is not good for markets.

M&A

So far bids have not started to bolster valuations. The supposed “dry powder” held by private equity firms has proved a little damp as higher interest rates have constrained them from gearing up to make acquisitions. Plus, their discounting assumptions will have changed, so deals have largely been in-market.

Brokers Cavendish recently published an interesting piece on acquisitions in the tech sector on AIM since 2017 (51 companies taken out, of which ten this year, for a total value of £23.3bn). They noted that takeout valuations have fallen relative to deals done pre-pandemic, even though the margins of the businesses were not materially down. Despite the general assumption that the cheap UK market was attracting foreign buyers, UK and US buyers were paying similar valuations. They see software companies as being the most popular areas for buyers. In our universe there have been two small cybersecurity companies taken out (ECSC and Osirium) and one delisting (the telco services company Pelatro).

In the life science area the only take-out in our group has been of Yourgene, bought by the cash-rich Novacyt. There have however been some acquisitions of larger life science companies – notably Dechra Pharmaceuticals, for £4.5bn in the first half of the year. The challenge for small drug development companies is to get large companies to take their products seriously, and to derisk them so that a buyer can deliver growth rather than have to invest more.

There has been – rightly – more focus on companies’ needs for further financing. Many companies will have come to AIM assuming, or having been told by their advisors, that delivering on plans and good news would lead to ever rising share prices and easy access to more equity when needed. That certainly is not the case at the moment. Companies with limited cash runways are being priced down on the basis that they will have no choice but to accept low and dilutive issues when they do have to come to the market. We are seeing managements cutting costs, cutting developments plans, and selling off the rights to non-core projects, and no doubt more of all these will come. Small and particularly pre-revenue companies do not always succeed in delivering. On the other hand, providing finance at low valuations and particularly being there at the last time a company needs to raise equity (or before it is taken over) can be rewarding.

In Conclusion

An overall repricing of the AIM market awaits some new sources of demand. It would be nice to think that the various discussions taking place around encouraging pension fund managers to invest in less-liquid areas of the market will bear fruit, but this is a hope for the medium term not the short term. In the shorter term our sense is that in-market consolidation is more likely to be the route to any repricing. But we have no reason to think it is arriving soon. Holders of AIM shares should be clearsighted about their holdings future cash requirements and not overcommit. On the other hand there are going to be bargains when companies are forced to raise money and have to raise it cheaply.

In this context, we continue to encourage our investors to build laddered portfolios of fixed income that provide regular income that can either be reinvested for the future or drawn down as income. This approach is highly cash generative and flexible in managing this very uncertain market environment. In addition to helping achieve one’s changing financial needs over time, it also provides a strong base from which other riskier equity opportunities can be considered.