Bonds

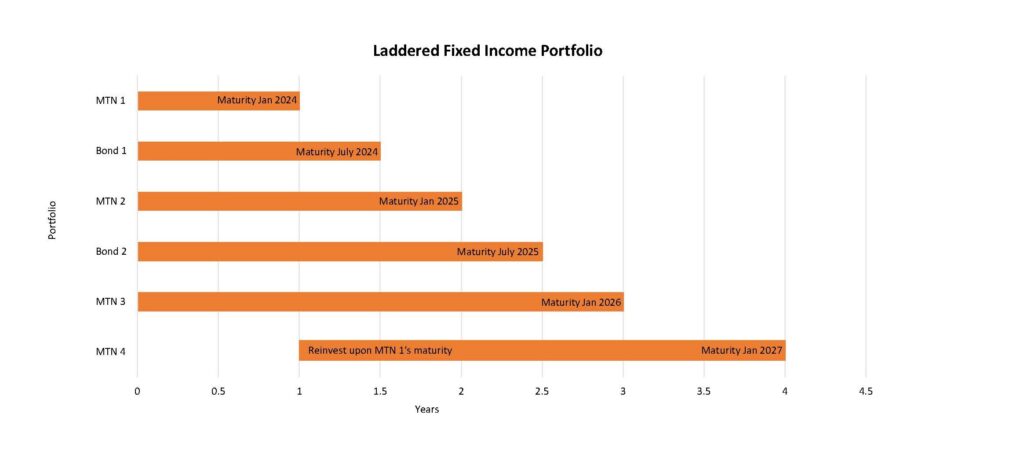

At LGB we are strong advocates of a Laddered Fixed Income Portfolio, an investment strategy consisting of an assortment of fixed income securities with staggered maturities. For our investors, this means building portfolios containing several fixed income investments with different maturity dates, ideally paying interest at different times too. It is intended that bonds are held to maturity so there is no active trading.

Advantages of Laddered Fixed Income Portfolios

Laddered portfolios have a number of advantages which we believe provide very strong foundations for any investment strategy, allowing investors to consider new opportunities from a position of strength:

- The portfolio will provide a steady stream of predictable income, with securities paying interest at different times throughout the year;

- Regular interest payments, capital amortisations and exposure to shorter maturities provide high levels of liquidity in the portfolio;

- Investors can mitigate risks through diversification;

- The investor is not locked into one investment position until maturity, and therefore has more flexibility to adjust his or her cash flow position according to requirements and the market conditions; and

- Having securities ‘roll off’ as they mature allows investors to manage interest rate exposure by re-investing at higher coupons when interest rates go up.

Why not just buy a fund or an ETF?

Managed bond funds and ETFs provide diversification benefits. They are also liquid. However they offer very different investment profiles: while a laddered portfolio receives bond redemptions at par and so amortises without reinvestment, a bond fund is a continuous investment. Investors should consider the following when choosing between direct investments or a fund:

- The sterling bond market – apart from gilts – is generally quite illiquid. Fund managers therefore confine themselves to bonds with consistent secondary market liquidity.

- Individual investors who do not require that liquidity have a broader choice of higher yield bonds, although high denominations in some bonds would restrict the choice for a smaller private investor.

- Market conditions constantly affect the value of a bond fund. If individual bonds and notes are held to maturity, investors are not affected by market risk.

- Investors looking for predictability and certainty for their financial goals may find individual bonds and loan notes a better fit.

- Individual holdings of Gilts and so-called Qualifying Corporate Bonds (QCBs – see below) are not currently liable to Capital Gains Tax. That advantage is lost if the bonds are held within a collective vehicle.

Building a Laddered Fixed Income Portfolio with LGB & Co.

LGB’s MTN programmes provide a regular flow of new issues, allowing investors to build laddered portfolios over time from the pool of issuers managed by LGB. There is no active secondary market in LGB’s MTN issues, although they can be sold in exceptional circumstances. In order to increase diversification further, and increase the liquidity in the portfolio, investors may seek to complement their MTN portfolios by adding longer and shorter maturity bonds. We have therefore teamed up with fixed income broker Allia City & Continental to provide our investors with a curated list of Sterling denominated bonds which are generally more liquid and can be bought in the secondary market through the LGB Investments platform.

ISAs Eligibility

Most bonds can be bought and held in LGB Investments ISA accounts,