LGB’s Market Commentary for Q3 2024

In the words of Bob Marley (on the 1977 album Exodus) “Don’t worry about a thing, ‘cos every little thing’s gonna be alright.” Certainly, whilst UK private investors fret about the forthcoming budget, some markets suggest that there is not much to worry about. The US has just hit a record high, with US banks back above where they were before Silicon Valley Bank failed; Bitcoin is back at $60,000; Tokyo whilst lower than the July high is still way above the levels of the last 20 years; and the FTSE 100 whilst lower than its May peak is still not that far off all time highs. The AIM market is of course not feeling the joy for reasons we have discussed elsewhere [How to prepare for the budget countdown] and which are not worth going over again this side of the budget.

Interestingly in the US the leadership of the “Magnificent Seven” has diminished: the S&P 500 was up 5.9% in Q3, whereas the S&P Equal Weight 500 (which as it says on the tin, eliminates the preponderant weighting of the largest stocks) was up 9% as was the Russell 2000 which includes smaller cap stocks. Investors looking for exposure to the US market without it being a bet largely on the Magnificent Seven can buy Equal Weight ETFs- for example iShares (Blackrock) offer this one on the S&P 500 which is available to purchase on the LGB investment platform.

The major market shock in the period was the 12% fall in the Nikkei on 5 August, which was quickly recovered. The People’s Bank of China’s stimulus policies have revitalised that market, and Hong Kong too: Shanghai Composite rose over 14% and the Hang Seng (HK) 21%.

Bond markets on the other hand have not returned to the QE-stoked highs of the long interlude of super-low rates that followed the Global Financial Crisis. Whilst the consensus from commentators is that rates are on a downward path, the market stubbornly refuses to listen and falls have been modest: mixed signals on economic growth in the US including recent high employment numbers and concerns about future Gilts issuance in the UK are among the reasons. To be fair, inflation does seem to be stabilising at lower levels across the G7, and forward curves do show falling rates, but Central Banks having undershot on the way up are playing it safe on the way down. We continue to recommend a laddered bond portfolio and note in particular the attractions to higher rate taxpayers of Gilts trading at discounts to par [for example 7 June 2025 Gilt is trading at 97.75] as well as LGB’s proprietary MTN issues. Recent MTN issues include a one year note for SRT Marine Systems at 12% and a 3 year note for Simply Asset Finance at 11% p.a.

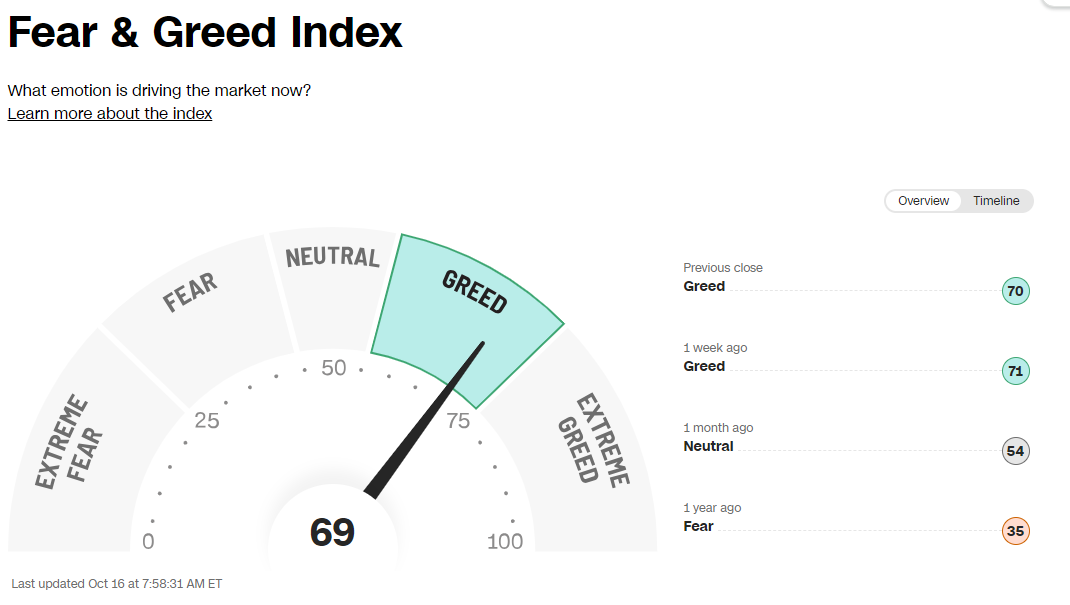

Are the equity markets overoptimistic? CNN Business in the USA produce a Fear & Greed Index, calculated using a mix of technical market indicators. It had recently edged into the “Extreme Greed” segment, though it has since dropped back into the merely “Greedy” segment. As with all technical indicators it should be approached with a degree of scepticism but is interesting as an indicator of sentiment.

The permabears are still out there. Jonathan Ruffer for example recently said “to my mind the probability of a setback – a really decent one – is likely, and likely not too distant either.” His overvalued targets include credit spreads (i.e. the premium of corporate over government debt which he argues is too low); volatility (again he believes it is too low); and equity markets generally as being “hollowed out by debt”. On a macro level conflict in the Middle East has the potential to disrupt supply chains and in particular oil; the Ukraine war will not stay frozen forever; the US election certainly has the potential to be problematic and China might just take advantage of an interregnum in Washington to move in the South China Sea. Investors wanting to learn more about the Ruffer approach should consult their website. The Ruffer Investment Company Ltd, their flagship fund, which embodies Ruffer’s absolute return philosophy trades on the London Stock Exchange under code RICA. The latest price (15 October) is 265p vs an estimated NAV of 292.4p, and it has a yield of 1.85%. Whilst its long term record is good it has underperformed in the last few years.

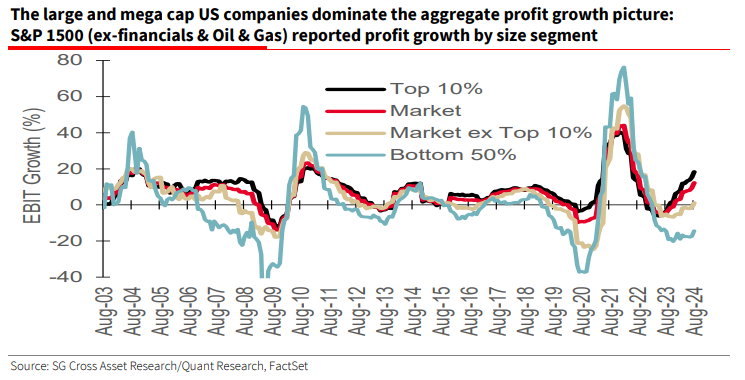

Self-confessed permabear Albert Edwards at Societe Generale has focussed on the damage high real interest rates are doing to the real economy in the US, the lack of earnings momentum behind the equity market highs and sees the US market as dangerously overbought. He has highlighted the relatively poor earnings trend outside the largest companies there:

If he is right (and he is also sceptical of the reliability of the employment stats in the US) then the US bond market will benefit as the Fed cuts (and the Fed is unlikely to want to risk a downturn ahead of an election, albeit it is supposed to be politically neutral). A list of USD denominated bonds is available on the LGB Deal Hub.

In conclusion- investors as always have a choice as to how much they try to de-risk their portfolio and to what extent they look for the greater returns that equities have provided over time. We will try at LGB to provide help and guidance in whatever you are looking at and our platform gives access to a very wide range of assets.

Lastly- a few ETFs (Exchange Traded Funds) are mentioned in the text. There are an enormous number of them, and pretty much all investment markets and many sub-markets will have a choice of providers: the ones mentioned are examples not our choices!